Excitement About Paul B Insurance Medicare Agent Huntington

4 Easy Facts About Paul B Insurance Medicare Agency Huntington Shown

Table of ContentsHow Paul B Insurance Medicare Advantage Plans Huntington can Save You Time, Stress, and Money.Not known Details About Paul B Insurance Medicare Health Advantage Huntington What Does Paul B Insurance Insurance Agent For Medicare Huntington Do?Some Known Details About Paul B Insurance Medicare Advantage Agent Huntington The Ultimate Guide To Paul B Insurance Local Medicare Agent HuntingtonThe 7-Minute Rule for Paul B Insurance Medicare Agent Huntington

For some procedures, in 2022, if the rating on that step was reduced than the previous year, the scores returned back to the 2021 worth to hold strategies harmless. An extra 2 percent of enrollees are in plans that were not rated because they are in a strategy that is as well new or has too low enrollment to get a score.The star scores showed in the figure above are what beneficiaries saw when they chose a Medicare prepare for 2023 as well as are different than what is used to identify perk payments. Recently, Medication, political action committee has actually elevated worries regarding the star rating system and top quality perk program, including that celebrity rankings are reported at the agreement instead than the plan degree, and might not be a beneficial indication of high quality for beneficiaries since they include a lot of procedures.

Choose a Medicare Supplement plan (Medigap) to cover copayments, coinsurance, deductibles, and also various other expenditures not covered by Medicare.

Rumored Buzz on Paul B Insurance Medicare Supplement Agent Huntington

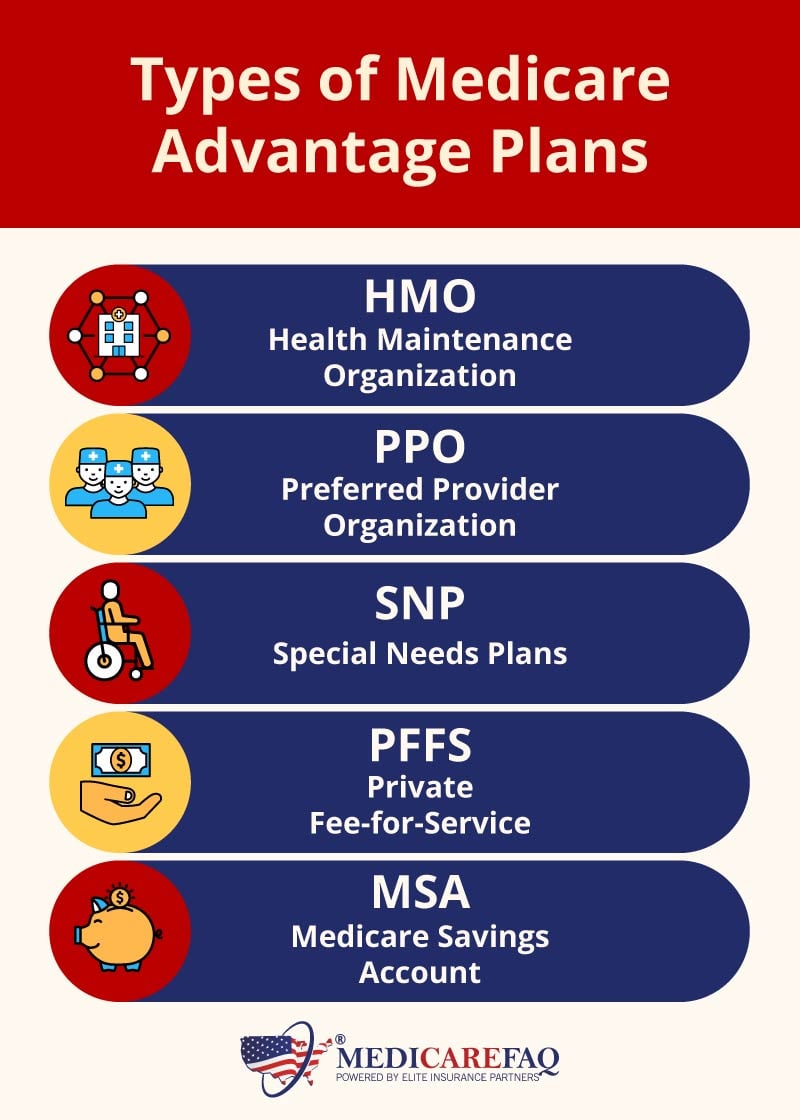

An HMO may need you to live or work in its service area to be qualified for coverage. HMOs commonly supply incorporated care and concentrate on prevention and also health. A sort of plan where you pay much less if you use physicians, hospitals, and also various other healthcare companies that come from the strategy's network.

A kind of health insurance plan where you pay less if you utilize suppliers in the plan's network. You can utilize medical professionals, healthcare facilities, and also carriers outside of the network without a recommendation for an added cost.

Having a typical resource of treatment has been discovered to improve quality as well as decrease unneeded care. The bulk of individuals age 65 and also older reported having a typical service provider or place where they obtain treatment, with a little greater prices amongst individuals in Medicare Benefit intends, people with diabetic issues, as well as people with high needs (see Appendix).

Not known Incorrect Statements About Paul B Insurance Medicare Advantage Agent Huntington

There were not statistically substantial differences in the share of older grownups in Medicare Benefit prepares reporting that they would always or commonly receive an answer about a clinical issue the exact same day they called their usual resource of care contrasted to those in typical Medicare (see Appendix). A larger share of older grownups in Medicare Advantage strategies had a healthcare professional they can quickly call in between doctor gos to for advice regarding their wellness condition (data not revealed).

Evaluations by the Medicare Payment Advisory Payment (Med, SPECIAL-INTEREST GROUP) have actually shown that, generally, these plans have lower medical loss proportions (recommending higher profits) than various other kinds of Medicare Advantage plans. This suggests that insurers' passion in serving these populations will likely proceed to grow. The searchings for likewise increases the essential to analyze these plans independently from various other Medicare Benefit prepares in order to make certain top quality, equitable treatment.

In particular, Medicare Advantage enrollees are most likely than those in traditional Medicare to have a therapy strategy, to have somebody that assesses their prescriptions, and to have a routine doctor or place of care. By giving this added aid, Medicare Benefit strategies are making it much easier for enrollees to get the assistance they need to manage their health and wellness care conditions.

What Does Paul B Insurance Medicare Part D Huntington Do?

The study results additionally question about whether Medicare Advantage plans are obtaining proper payments. Med, PAC approximates that plans are paid 4 percent greater than it would cost to cover comparable individuals in standard Medicare. On the one hand, Medicare Benefit plans seem to be providing solutions that help their enrollees manage their care, and also this added treatment administration could be of considerable worth to both plan enrollees and the Medicare program.

Component B matches your Part A coverage to provide protection both in and also out of the health center. Part An as well as Component B were the first components of Medicare developed by the government. This is why both parts together are typically referred to as "Initial Medicare." In addition, most individuals who do not have additional coverage through a team plan (such as those offered by employers) usually register for Parts An and also B at the very same time.

Getting My Paul B Insurance Insurance Agent For Medicare Huntington To Work

The amount of the costs varies among Medicare Advantage strategies. Medicare Advantage places a limitation on the amount you pay for your covered clinical treatment in a provided year.

Some Medicare Benefit plans require you to use their network of providers. As you discover your options, take into consideration whether you want to continue seeing your existing medical professionals when you make the switch to Medicare.

The Paul B Insurance Medicare Advantage Agent Huntington PDFs

What Medicare Supplement plans cover: Medicare Supplement intends aid handle some out-of-pocket prices that Original Medicare simply business insurance doesn't cover, including copayments and deductibles. That implies Medicare Supplement strategies are just offered to people that are covered by Original Medicare. If you select a Medicare Advantage plan, you're not eligible to buy a Medicare Supplement plan.